Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and knowable source. Who receive variable income have earnings reported on IRS 1099 or cannot otherwise be verified by an independent and knowable source.

P And L Statement Template Inspirational P L Statement Template Sample Workshe Profit And Loss Statement Profit And Loss Statement Templates Income Statement

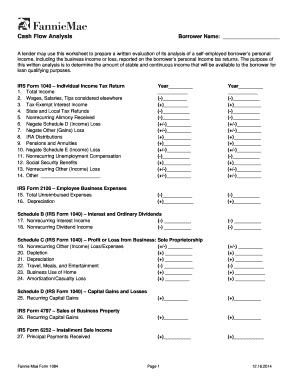

Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower.

Fnma self employed income calculation worksheet. If the borrower is the business owner or is self-employed the business ownerself-employed indicator must be checked along with the percentage of ownership. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Enter gross monthly rent from the lease agreement or market rent from Form 1025 for the applicable rental unit.

Borrowers with a 25 or greater ownership interest are considered self-employed. This form does not replace the requirements and guidance for the analysis and treatment of the income for self-employed. Schedule C Net Profit or Loss Sole Proprietorship.

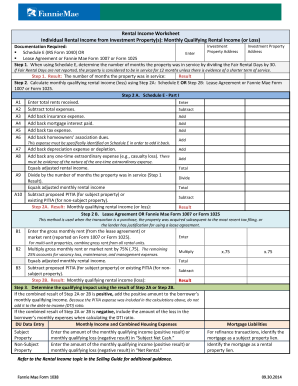

Calculate gross-up on non-taxable income sources prior year andor current year. Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment. Calculating Income 2 True or False.

Monthly Qualifying Rental Income or Loss Documentation Required. Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. A self-employed borrowers share of Partnership or S Corporation earnings can only be considered if the.

Some of the worksheets for this concept are Fannie mae cash flow analysis calculator Income calculations Income work for consumers Work for self employed Tax work for self employed independent contractors Schedule analysis method sam calculator Fnma self employed income Self employed borrower document. Multiply gross monthly rent or market rent by 75 75. Calculate base overtime bonus commission and other income sources.

DU will consider the borrower self-employed. Form 1040 - Individual Income Tax Return Yr. Evaluate variable income as either YTD or annualized.

A typical profit and loss statement has a format similar to IRS Form 1040 Schedule C. We get it mental math is hard. Amazing Cbc Self Employed Income Worksheet Printable Worksheets and Activities for Teachers Parents.

Rental Income Worksheet Individual Rental Income from Investment Propertys. Expand only the sections you need to complete select the circle next to the name of the income type. Form 1065 Ordinary Income or Loss Partnership.

This self-employed income analysis and the included descriptions generally apply to individuals. The lender must document and underwrite the loan application using the requirements for self-employed borrowers as described in Section B332 Self-Employment Income. Fnma Self Employed Worksheet - When it comes to you wanting to arranged goals for yourself presently there are several ways in which this could be done.

The remaining 25 accounts for vacancy loss maintenance and management expenses. Form 1120S Taxable Income S Corporation Determine the percentage change in gross income from one year to the next by. Who have 25 or greater interest in a business.

The Sellers calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. You could of course imagine about setting them. Self-Employed Borrower Tools by Enact MI.

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. DU will consider the borrower self-employed if the ownership share is 25 or more or if the ownership share is not completed but the business ownerself-employed. W-2 wages are always considered salary income and never self-employed income for Fannie Mae or Freddie Mac.

Self Employed Income - Displaying top 8 worksheets found for this concept. To estimate and analyze a borrowers cash. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income.

Please note that these tools offer suggested guidance they dont replace instructions or. Form 1120 Taxable Income Corporation. Determine income based on earnings dates.

This form is a tool to help the Seller calculate the income for a self-employed Borrower. Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income. Some of the worksheets displayed are Fannie mae cash flow analysis calculator Income calculations Income work for consumers Work for self employed Tax work for self employed independent contractors Schedule analysis method sam calculator Fnma self employed income Self employed borrower.

Cash flow and YTD profit and loss P. BUSINESS STRUCTURES Knowledge of the structure of the business that a self-employed borrowers has will assist the lender in evaluating the. FNMA Self-Employed Income Calculations FNMA considers any individual that has a 25 or more ownership interest in a business to be self-employed.

The net income from self-employment must be entered in the Base Income field in Section V. Self Employed Income Showing top 8 worksheets in the category - Self Employed Income. Allowable addbacks include depreciation depletion and other noncash expenses as identified above.

For employment and other types of income check out our Income Analysis worksheet. Or Form 1038 to calculate individual rental. Our editable auto-calculating worksheets help you to analyze.

Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. When calculating income we can always average total ytd pay and W-2s and enter the total into DU or Loan Product Advisor. A lender may use Fannie Mae Rental Income Worksheets Form 1037.

Note that for DU loan casefiles only the most recent year of tax returns may be required.

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 201084 202016 20case 20study 20part 20 20ii 20 20april 202017 Pdf

Profit And Loss Statement For Self Employed Template Business Balance Sheet Balance Sheet Template Income Statement Template

Costum Self Employment Income Statement Template Excel In 2021 Profit And Loss Statement Statement Template Income Statement Template

Self Employment Income Expense Tracking Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Self Employment Income Statement Template Luxury Free Profit And Loss Template Self Employed S Cash Flow Statement Statement Template Profit And Loss Statement

Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 201084 202016 20case 20study 20pt 20i 20 April 202017 Pdf

Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

Self Employment Income Statement Template Beautiful Self Employed Spreadsheet Templates Income Statement Template Statement Template Income Statement

Self Employed Daily Printable Time Sheet Daily Printable Printable Time Sheet Time Sheet Printable

Fannie Mae Self Employed Income Worksheet Fill Online Printable Fillable Blank Pdffiller

Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

Proving Income When Self Employed Fill Online Printable Fillable Blank Pdffiller

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb1084 Pt1 Presentation 0719 Pdf

Self Employed Expenses Worksheet Promotiontablecovers

Self Employment Income Expense Tracking Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Fannie Mae Rental Income Worksheet Fill Out And Sign Printable Pdf Template Signnow

Sample Cash Flow Analysis Template Cash Flow Analysis How To Be Outgoing

No comments:

Post a Comment